An Extension of the Team for Financial Advisors

As your client’s trusted financial advisor, retirement administration advice is undoubtedly an important area of concern. Yet fielding and servicing retirement plan business requires a team of technical experts and staff to handle the day-to-day administration and questions.

RPSI can help. We’ve been partnering closely with financial advisors to provide retirement plan administration advice—as well as retirement plan compliance advice—since 1992.

How RPSI Assists You with Retirement Administration Advice

Complete Support: We’ll meet for an initial consultation, design your client’s 401(k) or other plan, help with the paperwork, monitor the regulations, and answer day-to-day service questions so you can focus on adding new clients. At RPSI, our function is to be a partner and a support system for you.

How RPSI Serves Your Clients

Helping your clients understand and manage their fiduciary responsibility as a plan sponsor is just as important as plan design and investment performance. Our process will help them manage both internal and external factors.

- Internal factors: Business growth, profitability, employee retention needs.

- External factors: Legislative changes and DOL/IRS audits.

An Extension of Your Team

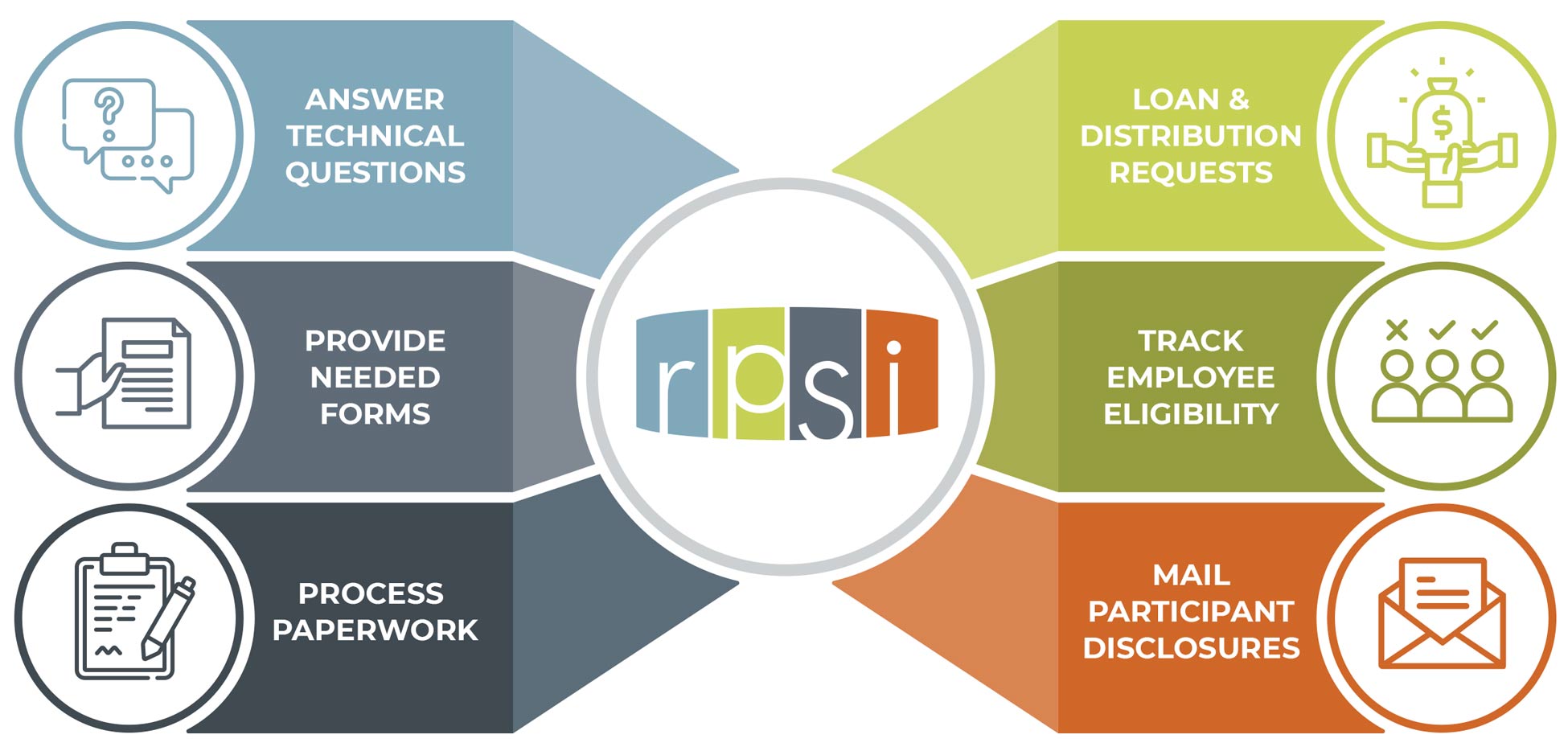

From prospect to close we will provide the following services. We don’t sell investment products or offer investment advice, so we’ll never compete with you.

You can rest assured knowing you have experts on your team to handle all your regulation and compliance needs.

Since 1992, RPSI has been committed to your success and providing the retirement administration advice that removes the frustrations and headaches associated with 401(k) and pension plans. We invite you to call to explore how we can best serve you.